US Consumer Spending Trends Reshaping Container Shipping Dynamics

Recent estimates from Sea-Intelligence reveal a notable trend in US consumer spending dynamics, indicating a continued increase in expenditure despite a slight dip in growth to approximately 5 percent. While spending on non-durable goods has maintained stability since 2021, February 2024 witnessed a marginal uptick, with the bulk of spending growth directed towards durable goods.

Read also: Surge in U.S. Inbound Containers Signals Economic Growth in 2024

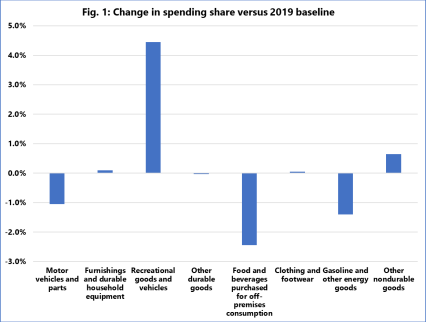

Illustrating this shift, Sea-Intelligence’s analysis highlights a significant alteration in the average proportion of total goods spending across major sub-categories between 2019 and February 2024. Notably, leisure items and automobiles have surged in proportional importance, rising from 10.2 percent of consumer expenditure in 2019 to 14.7 percent by February 2024.

Alan Murphy, CEO of Sea-Intelligence, underscores the nuanced implications of this spending trend, noting that while it bodes well for container shipping, the growth primarily stems from categories traditionally not reliant on container shipping. This divergence presents a challenge for shipping lines as the surge in the economy fails to translate into the expected uptick in container volumes.

Furthermore, Sea-Intelligence’s latest report indicates a consistent decline in spot rates over several months, suggesting a potential shift in the dynamics of container shipping amidst evolving consumer spending patterns.

This evolving landscape underscores the need for adaptability within the shipping industry, as traditional assumptions about container volumes are being challenged by changing consumer preferences. Navigating this terrain requires a nuanced understanding of emerging trends and a willingness to adjust strategies accordingly.

Leave a Reply